Author: Zhang Yaqi

Source: Wind Trading Platform

POP MART is entering a new round of rapid growth thanks to the strong IP-product flywheel effect. On the 28th, Monday, POP MART’s Hong Kong stock rose over 12%, reaching a historical high.

On April 24th, POP MART’s popular IP LABUBU launched the third generation of its vinyl plush product series “High Energy Ahead” globally. On the night of the product launch, the term “抢 labubu” (抢 means to grab) surged to the top of Weibo’s trending searches, and long lines were seen at POP MART’s offline stores in regions such as Los Angeles, USA, and London, UK.

According to Qimai data, on April 25th, the POP MART APP topped the shopping chart on the US App Store for the first time, jumping 114 places in one day and maintaining the first position for two consecutive days, while also ranking fourth in the overall free chart.

According to news from Wind Trading Platform, Morgan Stanley analyst Dustin Wei pointed out in a recent research report that the company’s plush bag charms have become its most important growth catalyst, achieving market expansion from “collecting” to “showing off,” significantly broadening the target customer base.

With the rapid expansion of overseas markets (especially in the United States and Southeast Asia) and the continued popularity of hot IPs like LABUBU and Nezha, Morgan Stanley expects POP MART’s sales to double in 2024, with a further growth of 47% in 2025, including a 27% growth in the Chinese market and a 77% growth in overseas markets.

Plush Bag Charms: The Growth Engine Turning Collectibles into Fashion Accessories

According to media reports, on April 25th, the LABUBU 3.0 series officially launched offline sales, with long lines forming at a POP MART store in Guangzhou. It is common for popular LABUBU series items to double in price on the second-hand market, and tripling is not unusual, especially for “hidden” and brand collaboration items with lower odds of being drawn.

For example, the LABUBU and Vans collaboration released last year, originally priced at 599 yuan, has already risen to 14,839 yuan in the second-hand market

POP MART, the giant in trendy toys, is experiencing unprecedented rapid growth. The company’s Q1 performance announced on the 22nd showed that POP MART’s overall revenue in Q1 increased by 1.7 times year-on-year, far exceeding industry expectations, with a significant acceleration in growth pace compared to 2024. The European and American markets are experiencing explosive growth, with revenue in the Americas skyrocketing by 9 times year-on-year.

There are many factors contributing to POP MART’s success, but the launch of plush bag accessories may be the most important demand catalyst.

Morgan Stanley stated that the collaboration between traditional IP toys and the fashion industry has a long history, with the partnership between Louis Vuitton and Takashi Murakami from 2002 to 2015 being one of the most famous cases. Now, more and more fashion enthusiasts are pairing POP MART’s bag accessories with handbags and backpacks, and this “fashion practicality” broadens the usage scenarios of IP toys, encouraging more consumers to purchase POP MART products and become familiar with its IP.

It is worth noting that POP MART’s plush bag accessories are typically 40-60% more expensive than blind box models, and the prices of large plush toys are several times higher than the latter. Although the gross margin of plush products may be slightly lower than that of model toys (mainly due to lower production automation), the higher unit price results in a higher operating profit margin.

Analysts expect that sales of plush toys (including bag accessories) will continue to grow rapidly, potentially reaching sales scales comparable to model toys. Currently, due to the lower level of automation in plush toy production and relatively low yield rates, the gross margin of plush products is slightly lower.

Rapid Global Expansion, U.S. Market Becomes Key Growth Point

POP MART’s successful global expansion is a key driver of its sustained rapid growth through 2025.

Morgan Stanley believes that the Southeast Asian market will continue to maintain high growth. By the end of 2024, POP MART is expected to have 10-12 stores in Southeast Asia (excluding Singapore), with plans to increase to about 20 stores by 2025 while maintaining high productivity.

POP MART’s success in Thailand provides a positive reference for the markets in Indonesia, Vietnam, and the Philippines. Especially in the Indonesian market, local consumers have shown enthusiasm for its IP/products comparable to that of Thailand.

The U.S. market will be a major growth area in the coming years, with the company planning to increase the number of stores in the U.S. from 20 in 2024 to over 40 in 2025. The productivity of its U.S. stores has increased from RMB 2 million in 2023 to RMB 2.5-3 million in the third quarter of 2024. With the growing popularity of IP and an increasing variety of products, analysts expect good same-store sales growth for U.S. stores in 2025.

In terms of e-commerce, online sales in the U.S. accounted for over 40% of fourth-quarter sales, with the main sales platforms being popmart.com, TikTok, and Amazon. Management expects the total number of stores in the U.S. to reach 200-300 in the long term.

In addition to its core business, POP MART is actively expanding into new businesses. For example, Pop Blocks (building blocks), POPOB (jewelry), dessert shops, fashion (Hirono series), micro-films, and Pop Land. Morgan Stanley believes that although the revenue contribution from these new businesses may be limited in 2025, their initial signs of success will help support POP MART’s valuation, as these new businesses target large global markets. The company expects Pop Blocks to become the fourth largest category after trendy toys, plush toys, and MEGA in the long term.

Morgan Stanley raises the company’s target price to HKD 135

Morgan Stanley’s financial forecast for POP MART:

Revenue: Expected to grow by 100%, 47%, and 26% in 2024, 2025, and 2026, respectively.

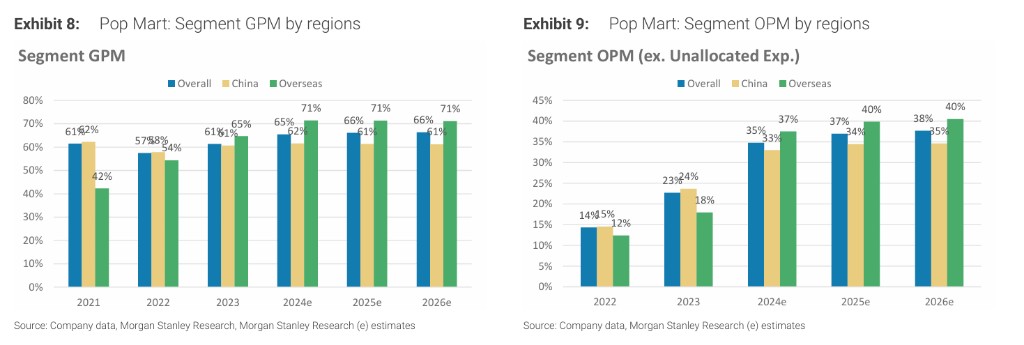

Gross Margin: Expected gross margins of 65.4%, 66.1%, and 66.3% in 2024, 2025, and 2026, respectively.

Sales and Management Expenses: Expected to decrease as a percentage of revenue in 2024, 2025, and 2026, thanks to operational leverage.

Net Margin: Expected adjusted net margins of 25.5%, 26.3%, and 26.3% in 2024, 2025, and 2026, respectively

Based on the above optimistic expectations, Morgan Stanley has raised the target price for POP MART from HKD 113 to HKD 135. The bank believes that in an optimistic scenario, if POP MART’s domestic and overseas markets grow rapidly and new business developments exceed expectations, the target price could reach HKD 166. In a pessimistic scenario, the target price may drop to HKD 79.

POP MART’s stock has risen 343% in 2024 and has increased 111% year-to-date in 2025. As of the time of publication, the company’s stock price is HKD 193.