[para. 1] In April, when Thai K-pop star Lisa posted a photo with a Labubu toy, it quickly became a sensation in Southeast Asia’s trendy toy scene. It sparked numerous unboxing videos that received tens of thousands of views, highlighting the popular appeal of Labubu. [para. 2] By July, a Labubu-themed store opened in Bangkok’s Mega Bangna shopping mall, achieving sales of over 10 million yuan ($1.38 million) in its first day. This success marked a record for Pop Mart International Group Ltd, a Chinese company specializing in such toys. [para. 3] Chinese toy companies, including Pop Mart, are leveraging the global fascination with media intellectual property (IP) products to expand their reach, especially among adult collectors. [para. 4] These trendy toys stand out for their unique designs, distinct personalities, and high-quality craftsmanship.

[para. 5] Pop Mart has been pivotal in driving this toy trend, particularly through its Labubu blind box series, which began in 2019. The series, part of “The Monsters” created by Hong Kong artist Kasing Lung, generated 626.8 million yuan ($86 million) in revenue in the first half of 2024, marking a 292.2% growth year-on-year. [para. 6] Pop Mart expanded to Southeast Asia with rapid store openings; by September 2023, the company had established multiple locations in Thailand due to strong celebrity endorsements, including from Blackpink’s Lisa.

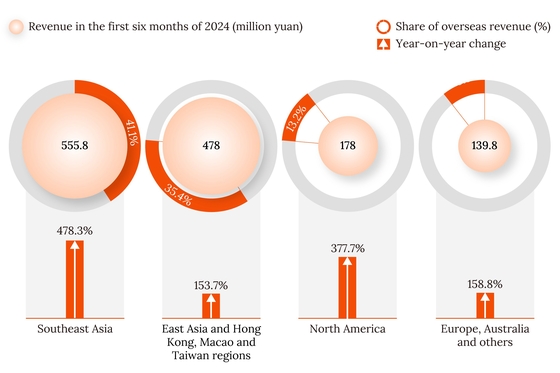

[para. 7] Singapore emerged as a key market due to high purchasing power, housing Pop Mart’s most extensive overseas presence. In the third quarter of this year, Pop Mart saw its overseas revenue grow by 440%-445% year-on-year, with Southeast Asia contributing significantly. [para. 10] Southeast Asia is an attractive market with over 600 million people, a youthful demographic, and a burgeoning middle class driving demand for IP-based products. [para. 11] The region’s toy market is projected to grow at a 7% annual rate, from $5.64 billion in 2023 to $6.52 billion by 2028, according to BridgeSEA Capital.

[para. 12] Pop Mart’s success has encouraged competitors like 52Toys and Miniso Group Holding Ltd.’s Toptoy to expand into Southeast Asia. [para. 14] 52Toys debuted in Thailand in December 2023 and quickly expanded, while Miniso plans to open over 1,000 stores in Indonesia. [para. 15] These companies are leveraging strategic expansion approaches, offering immersive store experiences and capitalizing on China’s comprehensive toy production supply chain to offer competitive pricing.

[para. 17] Pop Mart’s blind box model appeals to consumers through the element of surprise, allowing collectors to enjoy the thrill of the unknown at an affordable price. [para. 19] As competition rises, differentiation through exclusive IPs and tailored products is crucial. Pop Mart, for example, customizes product lines for specific markets, like its Lucky Cat series in Japan.

[para. 21] Sustaining growth, however, poses challenges. While expanding rapidly, trendy toy companies must consistently introduce new, appealing IPs to maintain consumer interest. [para. 24] Licensing fees for popular IPs can threaten profit margins unless companies secure exclusive rights. [para. 26] Despite these challenges, Pop Mart has achieved impressive growth, with Morgan Stanley predicting overseas sales and profits to exceed 50% of total sales by 2025. [para. 29] However, sustaining this momentum requires ongoing innovation in IP offerings, as initial consumer excitement can wane if product diversity stagnates.

AI generated, for reference only