Labubu is a doll characterized by its bunny-eared onesie and signature smiling, serrated teeth, created by Hong Kong artist Kasing Lung in 2015. Often described as either cute or creepy, Labubu has evolved from an obscure character into a cultural and commercial phenomenon, becoming a crucial driver of Pop Mart International Group Ltd.’s success[para. 1]. The dolls have been seen with global celebrities such as Rihanna and K-pop star Lisa, which helped skyrocket the brand’s profile. Pop Mart’s shares surged over 180% in 2024, lifting its market value to over HK$350 billion ($46 billion), ranking it as the world’s third most valuable intellectual property (IP) company after Disney and Nintendo[para. 2].

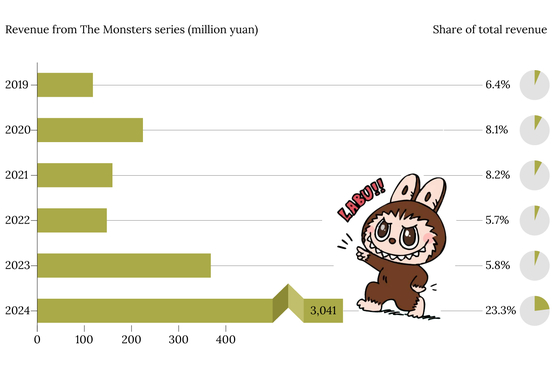

A significant milestone for Labubu occurred in June 2024 when a 131-centimeter figure sold at auction for more than 1.2 million yuan ($167,140), breaking records for the brand[para. 3]. This high demand has translated into robust financial performance, with the Labubu toy line accounting for nearly a quarter (23.3%) of Pop Mart’s total revenue in 2024. Some rare Labubu variants — like those with charcoal onesies and rainbow teeth — are especially prized, driving bidding wars and sometimes unruly scenes at retail stores. Pop Mart’s approach hinges on creating exclusive IP, manufacturing scarcity, leveraging social media, and the ‘blind box’ purchasing model, which gamifies shopping and entices collectors to buy repeatedly in pursuit of rare versions[para. 4][para. 7][para. 9].

The brand’s meteoric rise mirrors broader trends in Chinese cultural exports, such as the success of the Chinese-made video game “Black Myth: Wukong.” Analysts note that Labubu’s success signals China’s increasing global competitiveness in cultural industries[para. 5].

Pop Mart’s collaboration with Kasing Lung began in 2019, granting the company exclusive rights to produce Labubu figures. Initially, sales were modest, but the introduction of plush, portable versions in 2023 dramatically increased demand. The real tipping point came in 2024 when Lisa from Blackpink frequently displayed Labubu plushies on social media, sparking a buying frenzy across Southeast Asia[para. 10].

Financially, revenue from “The Monsters” series, led by Labubu, grew eightfold in 2024, and international revenue surged 375% to nearly 5.1 billion yuan. Southeast Asia became Pop Mart’s largest international market, making up nearly half of overseas revenue[para. 12]. In Thailand, demand outstripped supply, giving rise to a thriving gray market charging significant premiums. The craze spread globally, fueled further when Rihanna was seen with a Labubu in the U.S., prompting sellouts and even scuffles in stores abroad[para. 15][para. 16][para. 18].

Pop Mart’s business model is built on three pillars: exclusive or acquired premium IP, gamified retail through blind boxes, and intensive use of social media and celebrity endorsements. The viral success of Labubu illustrates how these strategies create mass-market trends, secondary markets, and collector communities[para. 27][para. 29]. The focus on plush, wearable toys made it easier for celebrities to showcase the product casually, enhancing visibility[para. 32].

Experts suggest that international expansion is crucial for global IP success. By 2024, Pop Mart operated 130 overseas stores, including locations on Oxford Street, London, and the Louvre in Paris. This made Pop Mart the first Chinese toy brand to be featured in the iconic museum and represents a disruptive move in the global collectibles market[para. 41][para. 42]. Pop Mart’s rise shows how Chinese companies are using reasonable pricing, product novelty, and strategic international retail expansion to become cultural and commercial disruptors[para. 43].

AI generated, for reference only